Atiku Warns Against ‘Bone-Crushing’ National Debt as Tinubu Seeks Fresh Loans

Former VP criticizes administration's borrowing plans, questions exchange rate benchmark for Eurobonds

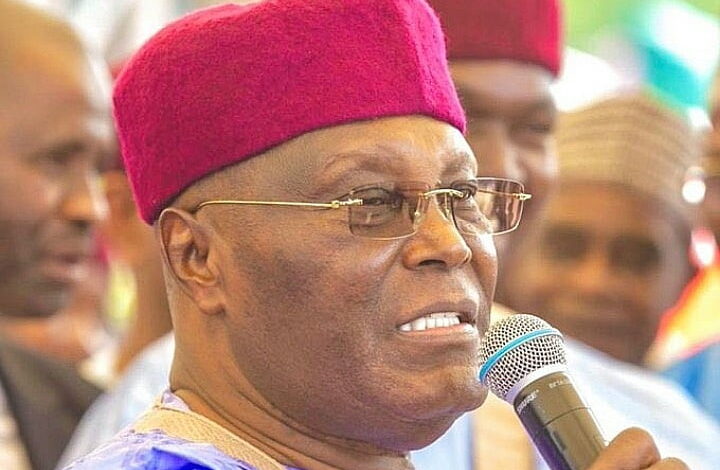

Former Vice-President Atiku Abubakar has raised alarm over Nigeria’s mounting debt profile, describing the current administration’s borrowing as putting “insufferable” pressure on the country’s economy. His comments follow a World Bank report ranking Nigeria as the third most indebted country to the International Development Association (IDA).

The former PDP presidential candidate particularly criticized the government’s recent proposal to the National Assembly for an additional 1.7 trillion naira Eurobond to cover the 2024 budget shortfall. Atiku questioned the loan’s exchange rate benchmark of 800 naira to the dollar, noting it significantly differs from the current Central Bank rate of over 1,600 naira.

“Nigeria is sinking further in debt, and the National Assembly has become an accomplice once more,” Atiku stated, questioning the necessity of additional borrowing when President Tinubu had earlier boasted of record-high revenue collections from FIRS and Customs. He suggested there might be undisclosed information affecting the country’s financial situation.

Expressing personal distress over Nigeria’s return to heavy foreign indebtedness after the Obasanjo administration’s debt relief achievements, Atiku pointed to a Budgit report that allegedly reveals concerning aspects of the 2024 budget. “It is concerning that the voracious appetite for these humongous loans is powered by corruption and not for infrastructure and development needs,” he argued.

The former vice president called for greater caution in the country’s approach to borrowing, emphasizing the need to “apply arithmetic to the loan frenzy.” These statements highlight mounting worries about the sustainability of Nigeria’s debt and the broader economic impact of current borrowing strategies.