Donald Trump’s 2024 Election Win: Business and Economic Implications of His Return to the White House

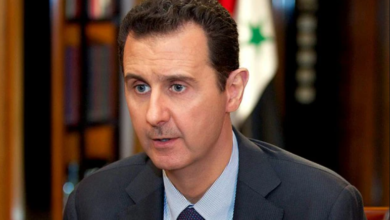

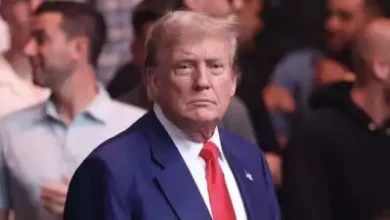

In a stunning political comeback, Donald Trump has won the 2024 U.S. presidential election, marking his second term in office and once again capturing widespread attention for his resilient campaign strategy. For many, this unexpected victory raises immediate questions about the future direction of U.S. economic and business policies, given Trump’s past emphasis on deregulation, tax reform and a protectionist trade stance.

Key Economic Policies on the Horizon

Trump’s return to the White House signals a likely shift back to his economic agenda from 2017-2021, characterized by corporate tax cuts, reduced regulations and an America-first trade approach. Businesses across industries are already analyzing the potential impact of these policies on sectors like manufacturing, energy and technology, which were central to his previous administration’s focus.

Tax Policy: Benefits and Potential Risks for Business

One anticipated policy move is a return to tax cuts for corporations and high earners. Such measures could improve short-term cash flow for businesses, especially those in sectors sensitive to capital expenditure and investment. However, this approach could also contribute to widening the federal deficit if not paired with budget adjustments. Economists suggest that while businesses may see immediate tax relief, the long-term impact on national debt could influence interest rates, thereby affecting business borrowing costs.

Trade Policy and U.S.-China Relations

Trump’s past tariffs and trade wars, especially with China, reshaped global supply chains. With another term, companies reliant on imports, particularly from China, may once again face tariffs or trade restrictions. In response, some businesses might seek to diversify suppliers or invest in domestic production, which could bolster American manufacturing but may raise costs for consumers.

Regulatory Environment: Opportunities and Challenges

Businesses in traditionally regulated industries, such as energy and finance, may anticipate reduced oversight, a hallmark of Trump’s previous term. Lower regulations could mean fewer compliance costs, which some companies view as an economic boon. However, sectors tied to environmental sustainability or green technology might face challenges as climate policies are likely deprioritized. The emphasis on traditional energy sectors could benefit oil, gas and coal industries while raising questions about the future of renewable energy investment and climate-focused initiatives.

Labour Market and Immigration Reform

Under Trump’s administration, immigration policies are likely to tighten, which could impact labour availability across industries reliant on foreign workers, such as agriculture, construction and technology. For businesses dependent on African and Hispanic immigrant workers, especially in sectors like farming, hospitality and healthcare, stricter immigration measures may lead to staffing shortages, increasing wage pressures and operational costs. Industries that benefit from cultural diversity and international talent, such as tech and innovation, could also face challenges in sourcing specialized skills, potentially prompting some companies to relocate operations or outsource to more immigration-friendly regions.

With a reduced influx of skilled and unskilled workers, these communities may experience significant economic impacts, affecting remittances and regional economies. This could shape business dynamics within the U.S., with industries needing to reconsider their workforce strategies and invest in automation or domestic workforce training programs.

Investor Sentiment and Market Reactions

Following the election, markets are already showing a mixed response as investors gauge Trump’s potential economic policies. Some analysts expect stock market volatility as businesses prepare for new regulations or tax structures, while others anticipate that reduced corporate taxes and deregulation could boost business profitability and, by extension, market performance in the coming months.

The Economic Road Ahead

Trump’s election presents both opportunities and challenges for U.S. businesses and the broader world economy. While tax reductions and deregulation may benefit certain industries, trade tensions and labour shortages could disrupt market stability. In the months ahead, businesses will be closely monitoring how Trump’s policy decisions unfold, preparing to adapt to shifts that could shape the U.S. economy for years to come.

One Comment